Are you a startup looking for a good accounting software ? There are many things you would consider before choosing a startup accounting software. Many startups choose free accounting software simply because they have a low budget, but after going through this article, you will be able to choose the best accounting software for your business without paying anything.

If you are looking for the best free accounting software that will allow you to generate invoices and receive payments, we have compiled a list of top free accounting software applications. These applications help users manage their finances and optimize workflow process. You can also create and send professional invoices, track orders and expenses and send them to anyone throughout the internet.

Wave

Best for: Sole proprietors and small businesses

Wave offers an extensive list of features for free – and they’re free forever. It’s a web-based software, and information is automatically backed up in the cloud. Wave allows you to manage accounts receivable, generate financial statements, and connect an unlimited amount of credit cards and bank accounts.

One downside of Wave? It doesn’t allow you to track accounts payable – the money a business owes to its suppliers or creditors. But that’s offset by great software design, simple setup, and included email support.

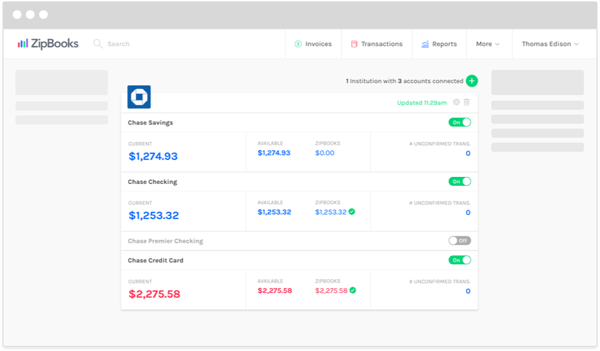

ZipBooks

Best for: Small businesses looking to upgrade from spreadsheets

ZipBooks is a web-based software offering a free plan called ZipBooks Starter. This plan includes basic bookkeeping functionality and profit & loss and balance sheet reporting. ZipBooks includes invoicing and quote features – and you can accept payment via credit card or PayPal. There’s a limit of one user and one connected bank account with the starter plan.

Xero

:max_bytes(150000):strip_icc():format(webp)/Xero-45875dde6ba545d19a5a15bc3d1cda83.png)

Xero is the best in our review for micro-businesses that are looking for very simple accounting software. This software has a clean interface and also fully integrates with a third-party payroll service. Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless.Pros

- Cloud-based

- Mobile app

- Payroll integration with Gusto

- Third-party app marketplace

- Simple inventory management

Cons

- Limited reporting

- Fees charged for ACH payments

- Limited customer service

Xero was founded in 2006 in New Zealand and now has over two million users worldwide. This accounting software is popular in New Zealand, Australia, and the United Kingdom. Xero has over 3,000 employees and is growing rapidly in the U.S., as well.

Xero offers three monthly subscription options and a full-service payroll add-on: Early at $11 per month, Growing at $32 per month, and Established at $62 per month. The full-service payroll option is offered through Gusto and is an additional $39 per month, plus $6 per employee. The company offers a 30-day free trial and a promotion for 50% off for two months.

The Early plan limits usage and only allows entry for five invoices or quotes, five bills, and reconciliation of 20 bank transactions per month. This limited plan may be suitable for a micro-business with high-ticket transactions, but only a few per month, such as a consulting or small service provider. Both the Growing and Established plans offer unlimited invoices, bills, and transactions. The only difference between the two is that the Established plan has additional features like multi-currency, expense management, and project costing. All three plans offer Hubdoc, a bill and receipt capture solution.

FreshBooks

:max_bytes(150000):strip_icc():format(webp)/freshbooks-f5c953441d184040a87d0d10fb0f7a84.png)

The most crucial accounting need for most service-based businesses is invoicing. FreshBooks offers more customizations for invoicing compared to other accounting software. Its primary function is to send, receive, print, and pay invoices, but it can also take care of a business’ basic bookkeeping needs as well. This accounting software makes it easier for service-based businesses to send proposals and invoices, request deposits, collect client retainers, track time on projects, and receive payments.Pros

- Cloud-based

- User-friendly interface

- Third-party app integration

- Affordable

- Advanced invoicing features

Cons

- No inventory management

- No payroll service

- Mobile app has limitations

Founded in 2003 in Toronto, FreshBooks started as just an invoicing software. Over time, more features have been added and FreshBooks now has over 500 employees. There are four different plans, and businesses can get a 10% discount if they choose to pay yearly, rather than monthly. Additionally, FreshBooks offers a 60% off discount per month for six months. The four plans are: Lite at $6 per month, Plus at $10 per month, Premium at $20 per month, and Select, which is a custom service with custom pricing.

The main difference between the four plans is the number of different clients that are allowed to be billed per month. In the Lite plan, up to five clients can be billed per month. In the Plus plan, up to 50 clients can be billed per month. In the Premium plan, unlimited clients can be billed per month. The Select plan also does not have a limitation on the number of clients that can be billed per month, but adds unique features. It costs an additional $10 per month for multiple team members to use the accounting software and it costs an additional $20 per month for the advanced payment feature, which allows users to charge a credit card in real-time or set up a recurring credit card charge for a client.

There are many third-party app integrations available, such as Shopify, Gusto, Stripe, G Suite, and more. A unique feature of FreshBooks is that invoices can be highly stylized and customized for a professional look and feel. FreshBooks is a great tool for budgeting out projects, sending estimates or proposals, and collecting customer payments.

QuickBooks Self-Employed

:max_bytes(150000):strip_icc():format(webp)/quickbooks-fb8d0be1585243bea88b156c3123df7f.png)

QuickBooks Self-Employed accounting software is our top choice for part-time freelancers and independent contractors who primarily want to track their income and expenses for their tax return. This software is designed for business owners who file a Schedule C on their individual tax return.

Without keeping up with business activity using a software like this, freelancers would need to dig through all of their bank and credit card statements to add up their income and expenses at the end of each year, which can be quite daunting. QuickBooks Self-Employed will total up all business transactions automatically.Pros

- Cloud-based

- Mobile app

- Track mileage

- Differentiate between business and personal expenses

- Syncs with TurboTax

Cons

- Data cannot be easily transferred to other accounting software

- Limited reporting

- Limited invoicing functionality and customization

QuickBooks Self-Employed is an Intuit product with a cloud-based online interface and a mobile app. This software was created to help freelancers stay organized each year for tax season. Features of QuickBooks Self-Employed include tracking mileage, sorting expenses, organizing receipts, sending invoices, and estimating and filing taxes seamlessly through TurboTax.

Users can choose between three plan options: Self-Employed at $15 per month, Self-Employed Tax Bundle at $25 per month, and Self-Employed Live Tax Bundle at $35 per month. There is a 50% discount for the first three months. The two tax bundles include a TurboTax subscription for income tax filing. The Self-Employed Live Tax Bundle also gives you access to a CPA to answer questions throughout the year and during tax season. The CPA will also perform a final review of your tax return in TurboTax prior to filing.

The mobile app makes it easy to track mileage while driving and capture photos of receipts for business expenses. Most accounting software is not designed to separate business transactions from personal transactions, but a special feature of QuickBooks Self-Employed provides an option to mark each transaction as business or personal. This is helpful for freelancers who don’t have a separate bank account for their business activity.

SlickPie

Best for: Small businesses with little experience bookkeeping

SlickPie is an easy-to-use software for those who lack bookkeeping experience. A huge perk of SlickPie is its automation features, which include auto-recurring invoices and a built-in app called MagicBot that allows you to automatically add bills and receipts. You can also manage accounts payable by manually entering bills and marking them paid.

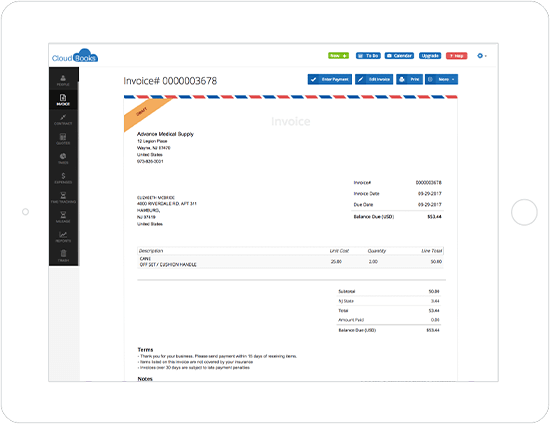

CloudBooks

Best for: Freelancers and small businesses

The free version of CloudBooks offers cloud storage, unlimited users, and email support. It has invoicing features but limits you to one client and five invoices. In order to get the unlimited invoicing features, a paid account will be necessary.

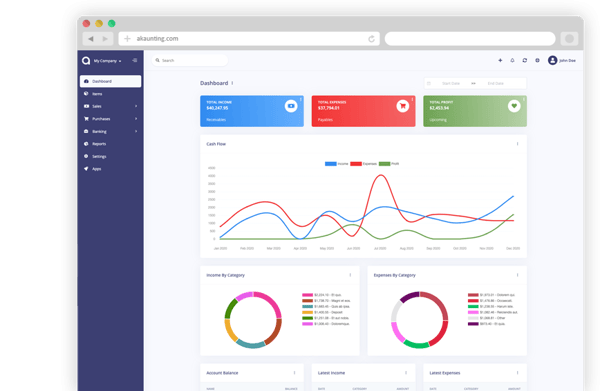

Akaunting

Best for: Small and medium-sized businesses

Akaunting has a full suite of online accounting services in one convenient tool. This application can be used on any device, and has an easy-to-use interface. Notable features include professional invoicing that can be sent across-currencies, expense tracking, client portals, and multi-company functionality so you can manage the financials of multiple businesses on one platform.

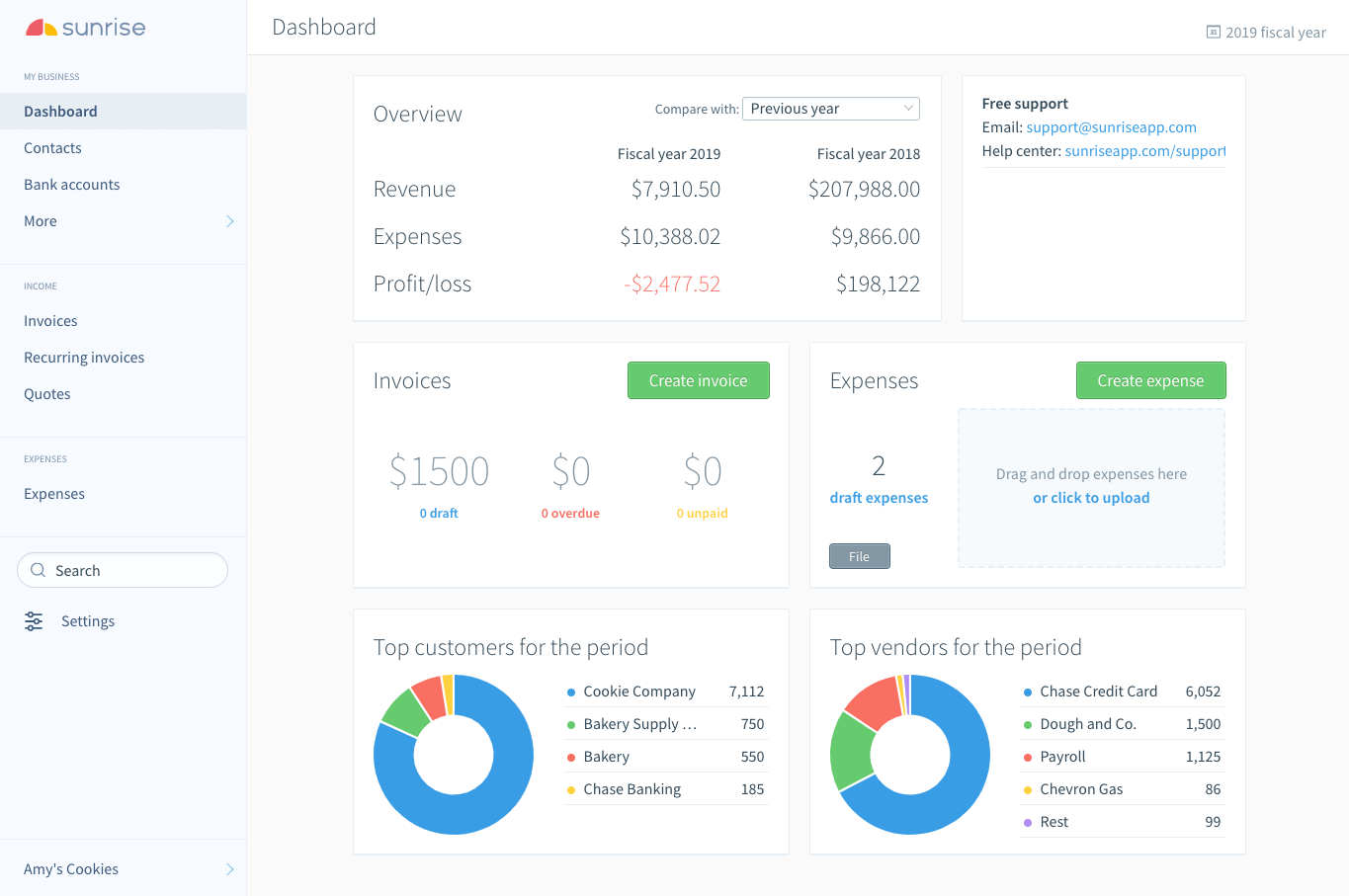

Sunrise

Best for: Small and medium-sized businesses

Sunrise provides bookkeeping software for small businesses. Users can easily search and categorize their business expenses, send customized invoices, and receive online and recurring payments. Their self service plan is free and allows users to send unlimited invoices, process unlimited transactions, and run cash flow reports. Sunrise also offers bookkeeping services for additional support.

Conclusion

Whether you’re a one-man-show or a team of 10 working out of your garage, accounting software will play an important role in keeping your finances organized and making sure you’re getting paid.

Free accounting software is a great way to manage finances and simplify business processes.

.jpg?width=600&name=slickpie%20(1).jpg)